As a mortgage broker, your expertise lies in understanding the complex intricacies of the property market and guiding your clients through the maze of lending options. But have you ever considered how crucial marketing is to your business success too? Marketing isn’t just for big corporate giants; it’s undoubtedly an indispensable tool for mortgage brokers like you. Here at Social Wave, we understand that your marketing efforts can either make or break your business in today’s competitive landscape.

Welcome to this comprehensive guide we’ve woven together just for you. It encompasses everything you need to know about marketing for your mortgage brokerage, teaching you about marketing funnels, exploring various channel options – both paid and organic – and delving into the critical factors that could determine your success.

But first, understand the marketing funnel

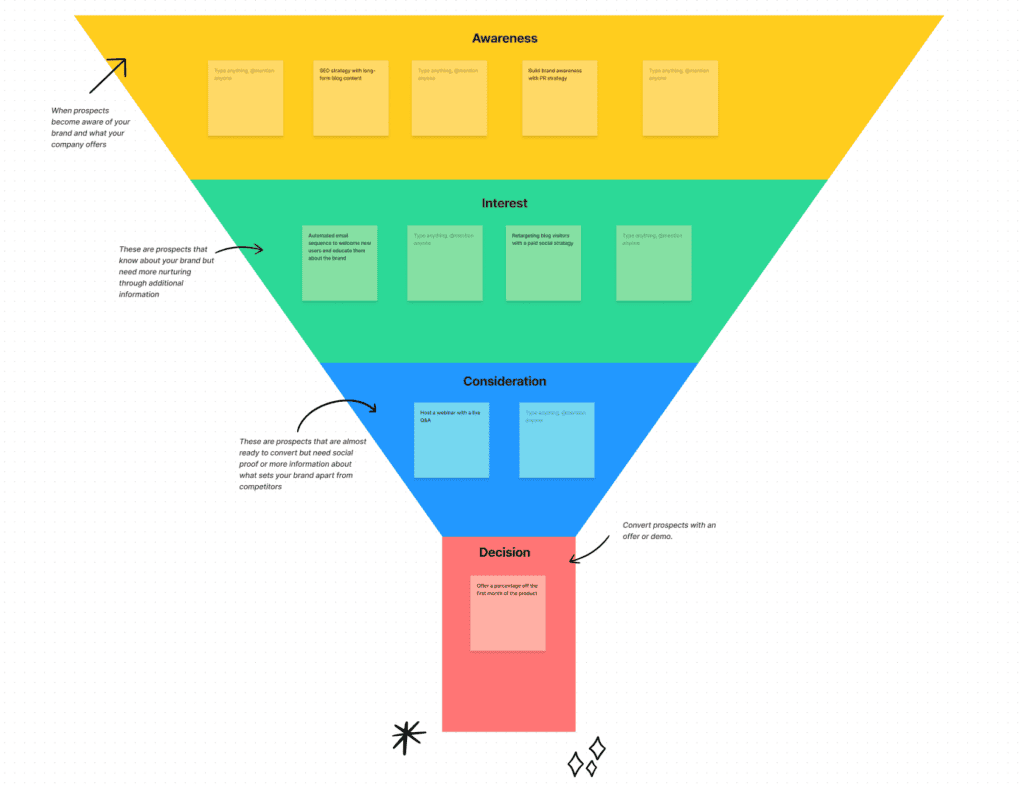

A marketing funnel is a model that represents the customer’s journey from the first point of contact with your brand to the ultimate goal of purchase. It’s often depicted as a funnel because it starts broad at the awareness stage, where potential customers first learn about your business, and narrows down to the conversion stage, where they decide to buy. This model is crucial in understanding customer behaviour and implementing effective marketing strategies.

In the context of the mortgage industry, a marketing funnel could start with a potential customer becoming aware of your brokerage through a blog post, podcast, or social media post. This is the top of the funnel, often referred to as the ‘awareness’ stage. Here, the goal is to reach as many potential customers as possible and draw them into the funnel.

Next, in the ‘interest’ stage, the potential customer might subscribe to your newsletter or follow your social media channels to learn more about your services. This is where you begin to build a relationship with them, providing valuable content and demonstrating your expertise in the mortgage industry.

The ‘consideration’ stage is where the potential customer starts to compare your services with those of your competitors. Here, you need to highlight your unique selling points, such as your exceptional customer service or competitive rates. This could be done through case studies, testimonials, or detailed service descriptions.

Finally, in the ‘action’ stage, the potential customer decides to apply for a mortgage through your brokerage. This is the narrowest part of the funnel and the ultimate goal of your marketing efforts. To encourage this action, you might offer a free consultation, a mortgage calculator tool, or a simple and streamlined application process.

Each stage of the marketing funnel requires a different approach and different types of content. By understanding this, mortgage brokers can create a comprehensive marketing strategy that guides potential customers through the funnel and maximises the chances of conversion.

Both paid and organic channels can be used at different stages of the marketing funnel. For instance, paid advertising might be effective at the awareness stage to reach a wide audience, while organic content like blog posts or podcasts can help build relationships and demonstrate expertise at the interest and consideration stages.

Key factors for success in using a marketing funnel include understanding your target audience, creating valuable and relevant content, and continuously analysing and optimising your strategy based on performance data. In the mortgage industry, where trust and credibility are crucial, providing clear, accurate and helpful information at every stage of the funnel can significantly increase your chances of attracting and converting potential customers.

What are my options for top-of-funnel awareness?

Creating a strong online presence is crucial for top-of-the-funnel awareness. This can be achieved through a well-designed, user-friendly website that clearly communicates your services and value proposition. Your website should be optimised for search engines (SEO) to increase visibility in organic search results.

Content marketing is another effective strategy. This involves creating and sharing valuable content to attract and engage your target audience. The content could be blog posts, ebooks, webinars, podcasts, or videos (e.g. YouTube) that provide useful information about mortgages and the home-buying process.

Social media platforms such as LinkedIn, Facebook, Twitter, and Instagram can also be used to increase awareness. Regularly posting engaging content and interacting with your audience can help build relationships and trust.

Email marketing can be used to reach potential customers directly. This could involve sending regular newsletters with useful content, or more targeted email campaigns to specific segments of your audience.

Paid advertising is another option. This could involve pay-per-click (PPC) advertising on search engines, or sponsored posts on social media platforms. These can be targeted to reach specific demographics or geographic locations.

Public relations (PR) activities can also help increase awareness. This could involve getting featured in industry publications, speaking at industry events, or partnering with other businesses or influencers in your industry.

Finally, referral marketing can be a powerful way to increase awareness. This involves encouraging your existing customers to refer their friends and family. This can be incentivised through a referral program.

Demand generation as a marketing methodology for mortgage brokers

Demand generation is a comprehensive marketing methodology that focuses on creating awareness and interest in a company’s products or services. It’s about building a demand for your offerings rather than just generating leads. This approach is more holistic and strategic, as it takes into account the entire customer journey, from the initial awareness stage to the final purchase decision.

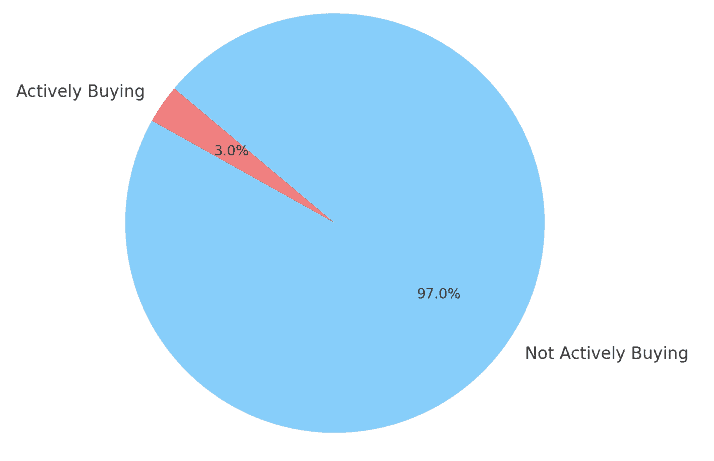

Lead generation and demand generation are two distinct strategies within the marketing spectrum. Lead generation primarily focuses on the 3% of the market that is actively seeking to purchase. This segment is already aware of their need or problem and is actively looking for solutions. The lead generation strategy is designed to attract these potential customers, capture their information, and nurture them through the sales funnel until they make a purchase.

Demand generation, on the other hand, targets the remaining 97% of the market. These are individuals who are not actively seeking to buy, either because they are unaware of their need, or they are not ready to make a purchase. Demand generation aims to create awareness and interest in your products or services. It involves educating potential customers about their unrecognised needs, demonstrating the value of your offerings, and nurturing them until they are ready to enter the buying cycle.

While both strategies are essential for a comprehensive marketing plan, they serve different purposes and require different approaches. Lead generation is more direct and immediate, focusing on short-term results. It often involves tactics like pay-per-click advertising, direct mail, or telemarketing. Demand generation is a longer-term strategy, focusing on building relationships and nurturing potential customers over time. It often involves content marketing, social media marketing, and SEO.

Why video marketing is the best for mortgage brokers

Video marketing holds a unique position in the realm of content marketing due to its ability to engage audiences in a dynamic and interactive way. For mortgage brokers, it offers an opportunity to explain complex financial concepts in a digestible and engaging format. This is crucial in the mortgage broker industry where understanding and trust are key factors in winning clients.

Furthermore, video content allows mortgage brokers to showcase their personality and build a personal connection with potential clients. This is particularly important in the mortgage industry, where building trust and rapport with clients is essential. A well-crafted video can provide a sense of the broker’s character, professionalism, and expertise.

Video marketing also aligns well with the consumer’s preference for visual content. It’s a well-known fact that people are more likely to remember information presented visually. This makes video a powerful tool for mortgage brokers to deliver their messages and ensure they stick.

Moreover, video content is highly shareable, which can significantly increase the reach of your marketing efforts. A compelling video can easily be shared across social media platforms, extending your message to a wider audience. This can be particularly beneficial for mortgage brokers, as it increases the chances of referrals.

Lastly, video marketing can significantly improve your SEO efforts. Search engines favour websites with video content, meaning that including videos on your site can improve your visibility online. For mortgage brokers, this can lead to increased traffic and more potential clients.

How the video algorithms work on social media

Social media platforms such as YouTube, Facebook, Instagram and TikTok utilise sophisticated algorithms to personalise content for their users. These algorithms are interest-based, meaning they use data from a user’s past behaviour to predict what they might like to see in the future. This includes the types of content they interact with, the accounts they follow, and the posts they share or comment on.

The algorithms also consider watch time, which is the total amount of time a user spends watching a particular video or engaging with a specific post. The longer the watch time, the more likely the algorithm is to recommend similar content to the user in the future. This is because a longer watch time indicates a higher level of interest in the content.

Retention is another key metric that these platforms use. It refers to the percentage of a video or post that users watch or engage with. For example, if a user watches 75% of a video, the retention rate is 75%. Higher retention rates suggest that the content is engaging and holds the viewer’s attention, which increases the likelihood of it being recommended to other users.

Engagement metrics such as likes, shares, comments, and saves are also taken into account by these algorithms. These actions indicate that a user found the content valuable or interesting, which signals to the algorithm that it should be shown to more people.

Interestingly, these platforms tend to show content to a mix of followers and non-followers. Typically, around 20% of the audience will be existing followers, while the remaining 80% will be non-followers. This is designed to help content creators reach a wider audience and boost their views without needing a large following. It also allows users to discover new content and accounts that they might not have found otherwise.

Understanding how these interest-based algorithms work can be a powerful tool for mortgage brokers looking to maximise their marketing efforts. By creating engaging content that holds viewers’ attention and encourages interaction, they can increase their visibility on these platforms and reach a larger audience.

Video’s most powerful asset – Repurposeability

The power of repurposing videos and podcasts cannot be overstated, especially for time-poor mortgage brokers. A single episode of a podcast or YouTube video can be transformed into a multitude of content forms, maximising your reach and engagement with minimal extra effort.

Consider the potential of vertical short-form videos. These are highly popular on platforms like Instagram, TikTok, Facebook, LinkedIn, and YouTube shorts. With the right editing, a single long-form video or podcast episode can be repurposed into several bite-sized clips, each tailored to the platform and audience they’re intended for. This not only extends your content’s lifespan but also increases its reach.

Another effective repurposing strategy is to convert your video or podcast content into an SEO-optimised article. This can be published on your website or blog, helping to boost your search engine visibility and drive more organic traffic to your site. It also caters to those in your audience who prefer reading over watching videos or listening to podcasts.

Email newsletters are another excellent way to repurpose your content. A summary or key takeaways from your video or podcast can be included in your regular newsletter, providing value to your subscribers and encouraging them to engage with your content in a different format.

Beyond these, there are other creative ways to repurpose your content. You could create infographics highlighting key points from your video or podcast, which can be shared on social media or your website. You could also use quotes or interesting facts from your content to create social media posts or graphics. The possibilities are endless, and the key is to think about how each piece of content can be adapted to fit different formats and platforms.

Ready to take the next steps?

In conclusion, the world of marketing for mortgage brokers is vast and complex, with numerous channels and strategies to consider. From paid to organic, each avenue offers unique opportunities to reach your target audience and grow your business.

Understanding and implementing a marketing funnel is crucial to ensure a steady flow of leads and conversions. However, the process can be time-consuming and requires a deep understanding of the market and your audience.

Here at Social Wave, we specialise in creating impactful podcasts, engaging videos, and effective SEO strategies that can help you navigate the marketing landscape with ease. Our services are designed to meet your specific needs, helping you to maximise your success.

Podcasts and videos allow you to share your expertise, build trust with your audience, and position yourself as a leader in your field. SEO, on the other hand, ensures that your online presence is optimised to attract and convert the right audience.

By partnering with us, you can focus on what you do best – providing excellent mortgage services, while we take care of your marketing needs. We invite you to enquire about our services and discover how we can help you maximise your marketing efforts and achieve your business goals.

Remember, the right marketing strategy can make all the difference in the success of your mortgage brokerage. Don’t leave it to chance – let us help you create a comprehensive marketing strategy that delivers results.

Get in contact with us today.